Unipol Gruppo: preliminary consolidated results for financial year 2023 approved - Proposed merger launched between Unipol Gruppo–UnipolSai

Voluntary tender offer on UnipolSai shares resolved

The board of directors of Unipol Gruppo S.p.A., which met under the chairmanship of Carlo Cimbri, analysed the preliminary results (consolidated and individual) for 2023. The definitive results will be examined by the governing body at its meeting scheduled for 21 March next.

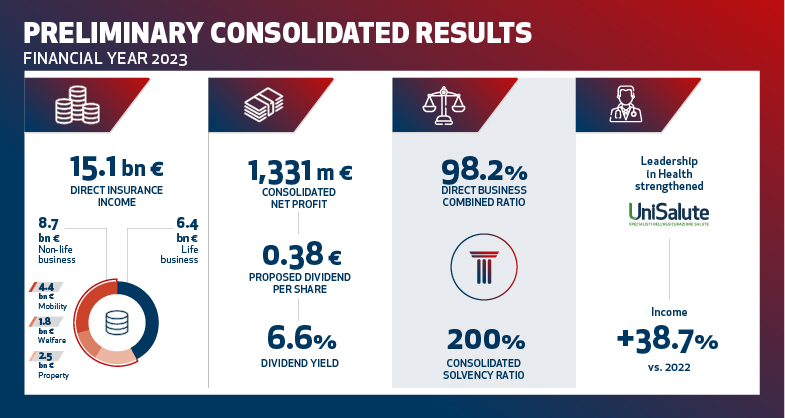

The Gruppo Unipol recorded a consolidated net profit of €1,331m for FY 2023, which includes a positive amount of €267m of badwill, recorded using the equity method to reflect the first-time consolidation of the stake in Banca Popolare di Sondrio (following the acquisition by Unipol Gruppo of 10.2% in the Bank increasing the overall stake of the Group to 19.7%).

Direct Insurance Income, including reinsurance ceded, stood at €15,060m as at 31 December 2023, up (+10.4%) on the amount of €13,645m at 31 December 2022.

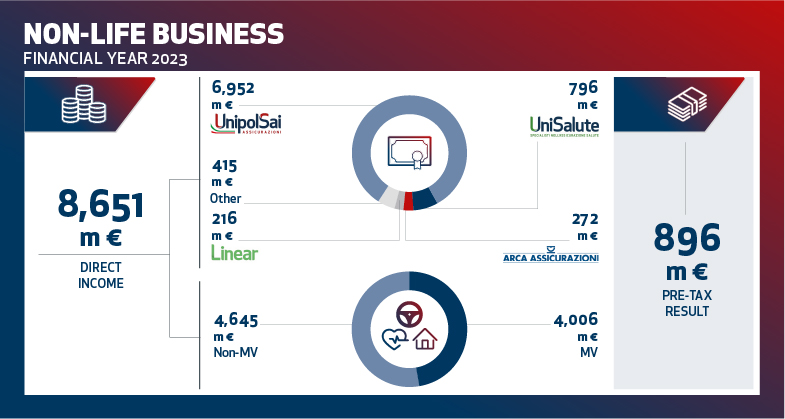

There was growth of 4.2% in direct Non-Life income to €8,651m, compared to the figure of €8,304m at 31 December 2022. In addition to the other main Group companies, the insurance company UnipolSai Assicurazioni contributed to this result, which recorded non-life premiums of €6,952m (+1.0%).

All the Ecosystem lines of business turned in positive performances.

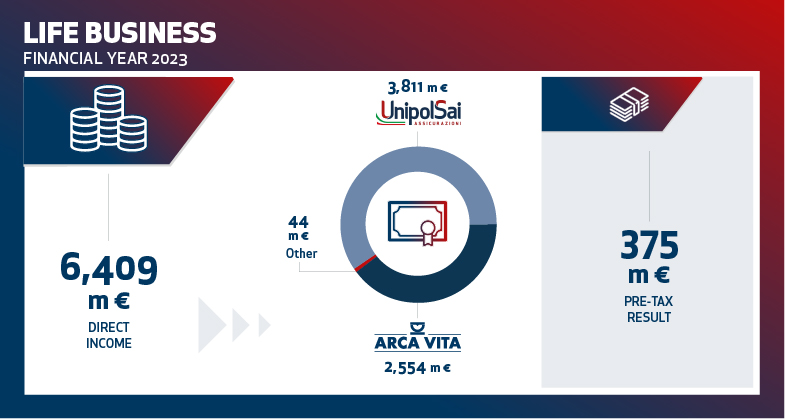

In the Life Business, the Group reported direct income of €6,409m, substantially up (+20.0%) on the figure of €5,341m recorded in 2022 despite ongoing market difficulties due to a general increase in interest rates and the uncertainties created by the Eurovita crisis, resolved in part due to the efforts by Gruppo Unipol.

- Consolidated net profit of €1,331m (€866m at 31 December 2022 as calculated with the accounting standards previously in effect)

- Higher dividend of €0.38 per share (dividend yield 6.6%) compared to €0.37 in 2022

- Direct insurance income increases to €15.1bn (+10.4% compared to 2022)

- Non-life: €8.7bn (+4.2%)

Positive performance in all lines of business of the Ecosystems:

-

- Mobility: €4.4bn (+3.0%)

- Welfare: €1.8bn (+7.4%)

- Property: €2.5bn (+4.0%)

-

- Life: €6.4bn (+20.0%)

- Combined ratio 98.2%

- Consolidated solvency ratio 200% (solvency ratio of the insurance business 239%)

- The proposed corporate restructuring of the Gruppo Unipol was approved; this will be achieved through the merger of UnipolSai into Unipol Gruppo in the context of which a voluntary tender offer will be launched by Unipol Gruppo for the ordinary shares of UnipolSai.

- Following the merger, Unipol Gruppo will be known as Unipol Assicurazioni S.p.A.

Read the complete Press Release.